Cost Of Auto Insurance - Rocky Mountain Insurance ... Can Be Fun For Anyone

Travelers provides safe chauffeur discount rates of in between 10% and 23%, depending upon your driving record. For those unaware, points are generally assessed to a chauffeur for moving infractions, and more points can lead to higher insurance premiums (all else being equal). 3. Take a Defensive Driving Course Sometimes insurer will provide a discount rate for those who finish an approved defensive driving course - dui.

Ensure to ask your agent/insurance company about this discount prior to you sign up for a class. After all, it is very important that the effort being expended and the cost of the course equate into a huge adequate insurance cost savings. cheaper. It's likewise essential that the driver sign up for a recognized course.

, think about going shopping around and obtaining quotes from contending business - cheaper cars. Every year or two it most likely makes sense to acquire quotes from other companies, simply in case there is a lower rate out there.

What good is a policy if the company doesn't have the wherewithal to pay an insurance coverage claim? To run a check on a specific insurance provider, think about checking out a site that rates the financial strength of insurance business.

In general, the fewer miles you drive your cars and truck per year, the lower your insurance coverage rate is likely to be, so always ask about a company's mileage thresholds. Use Mass Transit When you sign up for insurance coverage, the company will usually begin with a questionnaire.

Learn the specific rates to insure the various lorries you're thinking about before purchasing. 7. Boost Your Deductibles When choosing cars and truck insurance, you can typically pick a deductible, which is the quantity of cash you would need to pay prior to insurance coverage selects up the tab in case of an accident, theft, or other kinds of damage to the automobile.

Enhance Your Credit Score A driver's record is undoubtedly a huge element in determining car insurance expenses. It makes sense that a driver who has actually been in a lot of mishaps could cost the insurance coverage business a lot of money.

How Much Does Car Insurance Cost By State? - Progressive Things To Know Before You Get This

Regardless of whether that's true, be aware that your credit score can be an element in figuring insurance coverage premiums, and do your utmost to keep it high.

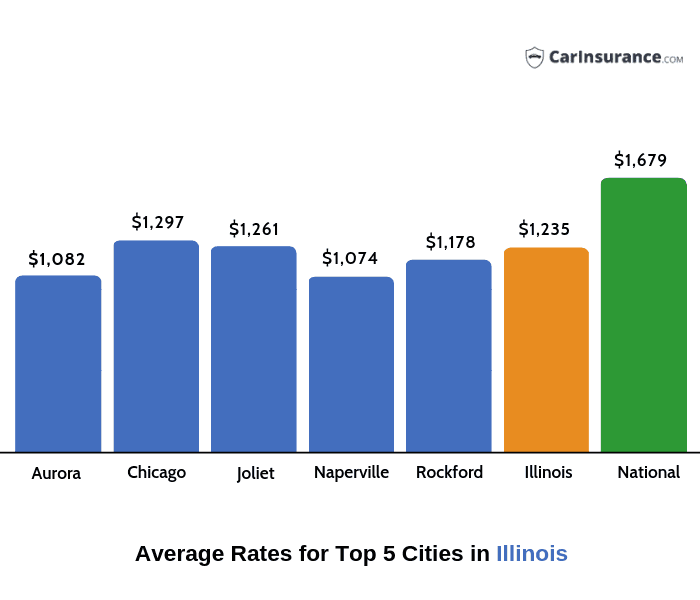

You can examine credit reports totally free at Annual, Credit, Report. com 9. Think About Location When Estimating Cars And Truck Insurance Coverage Rates It's not likely that you will relocate to a different state merely since it has lower automobile insurance coverage rates. However, when preparing a move, the possible change in your automobile insurance coverage rate is something you will wish to factor into your spending plan.

If the value of the car is just $1,000 and the accident coverage costs $500 per year, it may not make sense to buy it. GEICO, for example, provides a "possible cost savings" of 25% if you have an anti-theft system in your automobile (vehicle insurance).

Automobile alarms and Lo, Jacks are two kinds of devices you might want to inquire about. If your main motivation for setting up an anti-theft gadget is to reduce your insurance premium, think about whether the cost of including the gadget will lead to a considerable sufficient cost savings to be worth the difficulty and expenditure. credit score.

There are numerous things you can do to lower the sting. These 15 suggestions should get you driving in the ideal instructions.

It seems crazy to buy anything without knowing what you're going to pay for it, but that's what a lot of us do when it pertains to cars and truck insurance coverage. Many individuals purchase a car initially and just then begin believing about cars and truck insurance coverage and how much they'll pay.

You can find more details about your state here at Minimum Requirements by States. "State minimum" and "Standard Liability" policies are normally minimum or low-limit policies, supplying bare-bones protection. While these policies have lower rates, we advise greater limitations to make sure adequate protection ought to a mishap or automobile damage occur. auto insurance.

The 2-Minute Rule for Here's When You Will Get Your $400 Car Insurance Refund In ...

This will make you aware of what your insurance policy premium might be and allow you to spending plan for it appropriately-- or look for a provider that provides a better price offered your circumstance. How to start: Decide how much automobile insurance coverage you need, The three primary kinds of cars and truck insurance coverage you must understand are: Liability automobile insurance, Covers others' property damage and medical expenditures. vehicle insurance.

If you own a home or have a lot of cost savings 100/300/100 is advised. That indicates you're covered for $100,000 per person, up to $300,000 an accident for medical expenses for those hurt in an accident you trigger, and $100,000 for home damage that you trigger.

Lots of states' minimum liability requirements are so low that if you remained in a mishap, and it was identified or at least thought to be your fault, you could be susceptible to costly lawsuits, which indicates you might wind up losing your house or savings. We're thinking worst-case scenario and a really bad claim, however, still, it's something to think of.

Collision coverage, Covers damage to your cars and truck, no matter fault - insurance. If you are in a wreck you won't have to purchase a new car with absolutely no funds. This pays approximately the real cash value of your automobile if it is found to be an overall loss after a car accident.

You may not require extensive and collision protection if your vehicle is more than 10 years-old and not worth much. One of the finest ways to save on vehicle insurance expenses is to raise your deductible for collision and thorough insurance.

Expert Recommendations, Loretta Worters, Vice president, Insurance coverage Details Institute, Worters states that beyond simply liability or comprehensive vehicle insurance coverage, vehicle drivers should consider getting an umbrella policy, which is essentially an elegant term for additional insurance coverage, covering, basically, whatever under the sun."Umbrella insurance coverage can supply coverage for injuries, home damage, certain lawsuits, and individual liability scenarios.

Request rates from at least three various insurance companies. low cost. Be sure to compare the very same automobile insurance protection by utilizing the very same liability limitations, similar deductibles and optional protections.

Not known Factual Statements About Car Insurance Rates By State 2022: Most & Least Expensive

Nevertheless, the amount state-mandated liability insurance coverage pays for accidents might not suffice to cover the expenses, leaving you to pay the distinction - auto. Professional Guidance, Mark Friedlander, Director of corporate communications for the Insurance Details Institute"Opportunities are that you will require more liability insurance coverage than the state requires because mishaps cost more than the minimum limitations," observes Mark Friedlander.

For those reasons, you may desire to increase your security to higher physical injury liability limits and higher home damage liability limits: $100,000 per individual, up to $300,000 a mishap for medical bills for those hurt in an accident you trigger, and $100,000 for home damage that you trigger. For cost-conscious consumers with older cars, it may not deserve the money to insure versus damage to your vehicle.

If your cars and truck deserves less than 10 times the premium that you are spending for these extra coverages, acquiring these coverages may not be cost efficient. If you take this route, be prepared to pay for all associated losses out of pocket."How do I lower car insurance coverage rates? Think about following these tips to decrease the cost of car insurance without compromising protection.

You can call companies directly, access information online or deal with an insurance coverage representative who can get the quotes for you and help you compare."Keep a tidy driving record and inspect your driving record for accuracy, fix any errors. Examine safety ratings and buy a lorry that's thought about safe by insurance companies. auto.

Has appeared often on Good Early morning America looks, Shopping for car insurance is like shopping for anything else."As soon as you settle on a cars and truck insurance coverage provider, this is not your supplier for life.

Case in point, my hubby and I were with the exact same supplier for many years. We assumed that we were getting the very best rate, like we were when we first registered, but when we went shopping around, we realized we could do a lot better. Also, if your credit rating enhances gradually, you might receive a more favorable car insurance rate".

That means you have an idea of what you'll pay without needing to provide any individual details. affordable auto insurance. Nevertheless, when getting real quotes from insurer, you'll typically need to supply at least the following: Your license number, Vehicle identification number, Your address, or where the car is kept when not on the roadway, Regularly asked questions while approximating cars and truck insurance expenses, You've got more questions? We have the answers.

The Only Guide to Average Car Insurance Costs In 2022 - Nerdwallet

org, Powered by A Plus Insurance, She encourages consumers when looking for insurance estimates to ask a lot of questions, and if you're speaking with a broker, enable yourself enough time on the phone to get the correct descriptions and information about your policy. suvs. When comparing car insurance coverage rates, it is essential to take a look at the cost, make sure the protections match with every quote so you are comparing apples to apples, and take a look at the insurer's credibility," Mckenzie says.

And was the MVR (motor car report) run on each quote, What are the elements that impact car insurance coverage rates? A variety of ranking aspects figure out how much you will pay for car insurance.

https://www.youtube.com/embed/I_0CHSkS-18

Kind of cars and truck, Age & years of driving experience, Geographical location, Marital status, Driving record, Yearly mileage, Credit history, Chosen protection, limits and deductibles, Why some automobiles are cheaper to guarantee than others? Car insurance companies track which cars have the most wrecks and the worst injury records. Those elements affect the expense you spend for liability insurance coverage-- which covers the damage you trigger to other and not the damage to your car. cheaper.